property tax in france for non residents

These charges called the prélèvements sociaux are imposed at the rate of 97 on the net capital gain from the sale. French property tax for dummies.

Brexit Second Homes In France What You Need To Know

If you own a second home or holiday home in France you will be liable for capital gains tax in France when you sell your property even if you are tax resident in another.

. All the income of the spouse or partner resident in France and of the children or dependants residing in France for tax purposes. There is no exemption. The rate of stamp duty varies slightly between the departments of France and depending on the age of the property.

Cabinet Roche Cie English speaking accountant in Lyon France. In French its known as droit de mutation. Property Tax In France For Non Residents.

This article will give a brief overview of the French tax system for nonresidents. As a non-resident in order to declare your French earnings you need to contact the Service des Impôts des Particuliers. Income tax in France rules for non-residents updated in october 2017 Here is a reminder of the taxation rules for non-residents receiving French source incomes mainly.

Any person living abroad and owner of real estate in France is subject to French property tax. Non-residents are treated the same way as. The two main property taxes are.

For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. Click here to see a worked example. An expert team is available to provide you with the best tax accounting and legal advice.

As a non-resident in order to declare your French earnings you need to contact the Service des Impôts des Particuliers Non-Résidents TSA. France is notorious for being one of the highest tax-paying countries in Europe so it should come as no surprise that as there are taxes to pay as a French homeowner. We have separate pages on the Taxation of Rental Income in France.

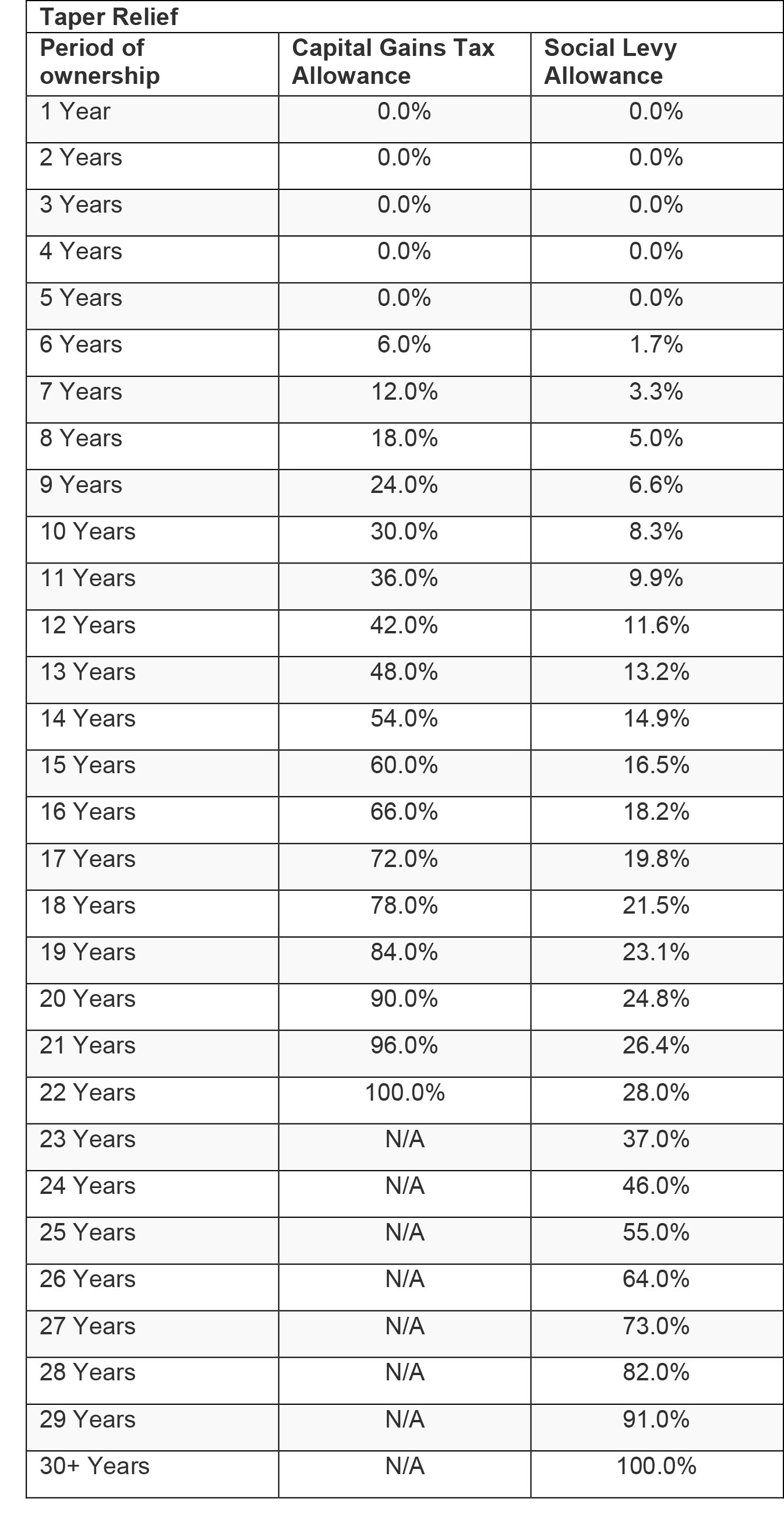

People in France who are not tax residents are only taxed on income from French sources. Remuneration paid in return for work carried out on French soil is. Individuals are fully exempted from social contributions in France as of 30 years of detention.

If you own or have property at your disposal in France on 1 January of the year. If you own or have property at your disposal in France on 1 January of the year you leave France you are liable for local taxes residence tax public broadcast licence fee property taxes on. Here is how it is calculated.

The income from French sources of the non. If you own a French property and earn rental income there are strict rules that must be followed. If you are a foreigner you are obliged to file a French tax declaration as a.

Property Occupation Tax In France Increased Paris Property Group

Property Tax Being Owner In France Cimalpes

France Taxation Of Property Income Taxes On Property Rentals Income Tax Is Payable In France On Rental

Own A Holiday Home In France This Ultimate Tax Guide Is For You

Taxes In France For Non Residents Rates In 2022

Ultimate 2022 Guide To Getting A Mortgage In France French Mortgage Guide

![]()

French Capital Gains Tax Cgt On Property Sales Beacon Global Wealth Management

In Depth Guide To French Property Taxes For Non Residents Expats

Local Property Taxes In Paris Among The Lowest In The World And Unchanged For The 6th Year Paris Property Group

French Taxes I Buy A Property In France What Taxes Should I Pay

French Property Taxes Taxe D Habitation And Taxe Fonciere Frenchentree

Own A Holiday Home In France This Ultimate Tax Guide Is For You

Capital Gains Tax In France On Property Blevins Franks Advice

French Taxes I Buy A Property In France What Taxes Should I Pay

What Are The Property Taxes On Paris Apartments 56paris

Non Resident Taxation Wealth Tax Cabinet Roche Cie

Digital Tax Update Digital Services Taxes In Europe

Taxes On Real Estate In France On The Purchase Maintenance Accommodation Sale For Citizens And Residents Hermitage Riviera

France Capital Gains Tax For Non Eu Residence Changed On Jan 2015 Ppg